Property Tax Rates In Us Cities . most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. this data is predictive and is gathered over a 5 year period via the u.s. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. We ensure that our property tax data is accurate. In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. among the report’s key findings: data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,.

from americantaxsavings.com

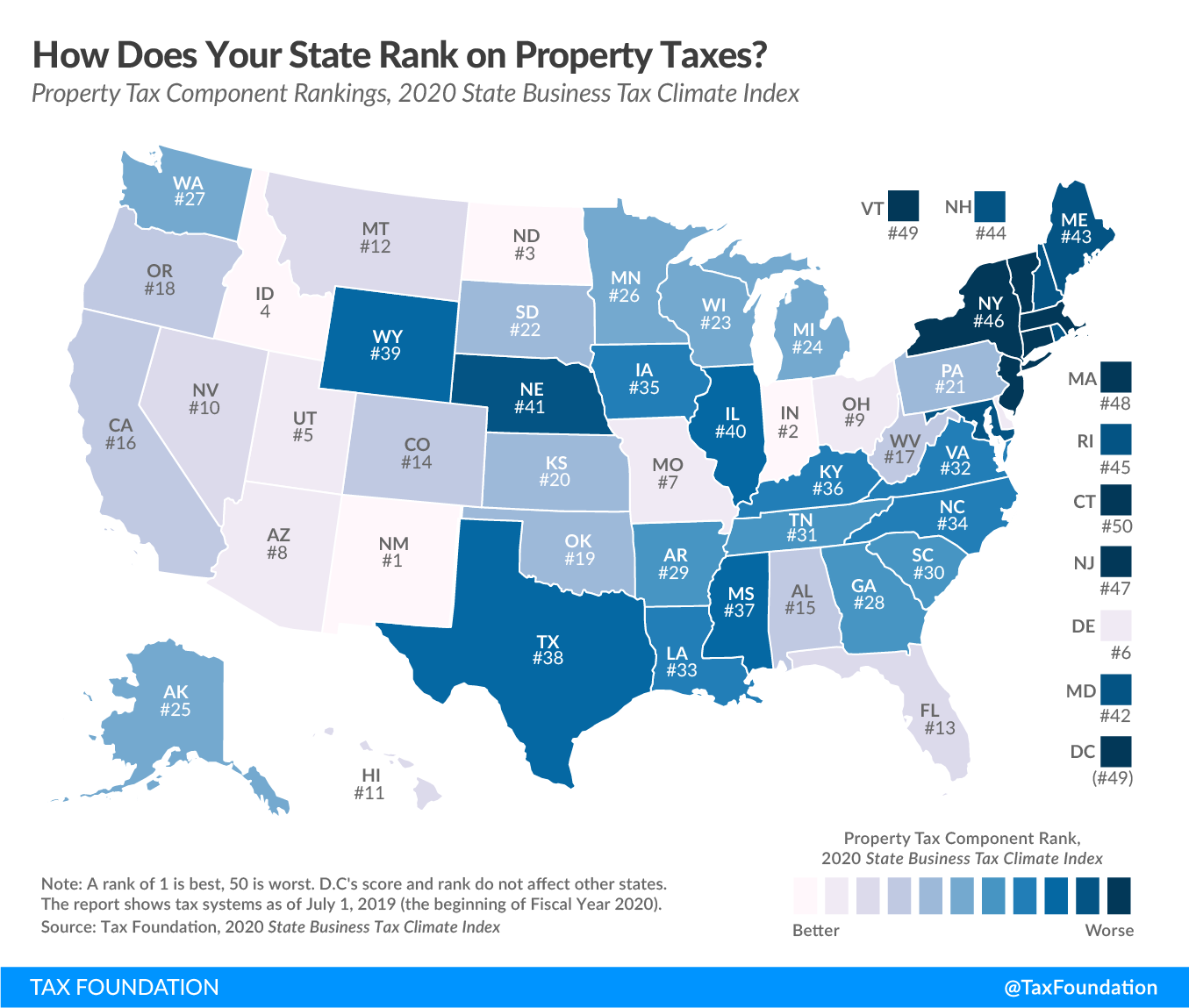

this data is predictive and is gathered over a 5 year period via the u.s. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. We ensure that our property tax data is accurate. among the report’s key findings: cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of.

News American Tax Savings

Property Tax Rates In Us Cities data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. We ensure that our property tax data is accurate. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. among the report’s key findings: data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. this data is predictive and is gathered over a 5 year period via the u.s. In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rates In Us Cities We ensure that our property tax data is accurate. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. this data is predictive and is gathered over a 5 year period. Property Tax Rates In Us Cities.

From learn.roofstock.com

U.S. cities with the highest property taxes Property Tax Rates In Us Cities In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. among the report’s key findings: at the state level, the northeast and midwest tend to have. Property Tax Rates In Us Cities.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rates In Us Cities this data is predictive and is gathered over a 5 year period via the u.s. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. We. Property Tax Rates In Us Cities.

From alyssagodwin.com

Hampton Roads Property Tax Rates Property Tax Rates In Us Cities among the report’s key findings: We ensure that our property tax data is accurate. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. this data is. Property Tax Rates In Us Cities.

From www.msn.com

5 cities with the highest property tax rates. Here's why rates can vary Property Tax Rates In Us Cities this data is predictive and is gathered over a 5 year period via the u.s. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. . Property Tax Rates In Us Cities.

From omaha.com

The cities with the highest (and lowest) property taxes Property Tax Rates In Us Cities We ensure that our property tax data is accurate. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. most local governments in the united states impose a property tax, also. Property Tax Rates In Us Cities.

From www.empirecenter.org

New York Property Tax Calculator 2020 Empire Center for Public Policy Property Tax Rates In Us Cities most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. We ensure that our property tax data is accurate. In urban and. Property Tax Rates In Us Cities.

From www.attomdata.com

Total Property Taxes Up 4 Percent Across U.S. In 2022 ATTOM Property Tax Rates In Us Cities this data is predictive and is gathered over a 5 year period via the u.s. In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. We ensure that our property tax data is accurate. among the report’s key findings: most local governments in the united states impose a. Property Tax Rates In Us Cities.

From www.joancox.com

Property Tax Rates Property Tax Rates In Us Cities among the report’s key findings: most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. We ensure that our property tax data is accurate. this data is predictive and is gathered over a 5 year period via the u.s. at the state level, the. Property Tax Rates In Us Cities.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rates In Us Cities most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid.. Property Tax Rates In Us Cities.

From www.pinterest.com

15 Cities with Highest Estate Tax Rates Tax Relief Center Estate Property Tax Rates In Us Cities In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. this data is predictive and is gathered over a 5 year period via the u.s. We ensure that our property tax data is accurate. cities were ranked according to their effective property tax rate, measured as aggregate real estate. Property Tax Rates In Us Cities.

From myelisting.com

Avoid The Pain Of Soaring Property Taxes With Our Guide The 5 Best And Property Tax Rates In Us Cities among the report’s key findings: at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. this data is predictive and is gathered over a 5 year period via the u.s. data are available for 74 large us cities and a rural municipality in each state, with information. Property Tax Rates In Us Cities.

From masslandlords.net

How Much Are Your Massachusetts Property Taxes? Property Tax Rates In Us Cities data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. In urban and rural areas, the average effective property tax rate in. Property Tax Rates In Us Cities.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rates In Us Cities data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. most local governments in the united states impose a property tax, also known as. Property Tax Rates In Us Cities.

From www.taxmypropertyfairly.com

Upstate NY Has Some of the Highest Property Tax Rates in the Nation Property Tax Rates In Us Cities among the report’s key findings: cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. at the state level, the northeast and midwest tend to have the highest effective property tax rates, led by. this data is predictive and is gathered over a 5 year period via the u.s.. Property Tax Rates In Us Cities.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Property Tax Rates In Us Cities cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. data are available for 74 large us cities and a rural municipality in each state, with information on four different property types (homestead, commercial,. among the report’s key findings: In urban and rural areas, the average effective property tax rate. Property Tax Rates In Us Cities.

From wallethub.com

Property Taxes by State Property Tax Rates In Us Cities In urban and rural areas, the average effective property tax rate in the united states is fairly consistent for. cities were ranked according to their effective property tax rate, measured as aggregate real estate taxes paid. We ensure that our property tax data is accurate. among the report’s key findings: most local governments in the united states. Property Tax Rates In Us Cities.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Property Tax Rates In Us Cities most local governments in the united states impose a property tax, also known as a millage rate, as a principal source of. this data is predictive and is gathered over a 5 year period via the u.s. among the report’s key findings: We ensure that our property tax data is accurate. at the state level, the. Property Tax Rates In Us Cities.